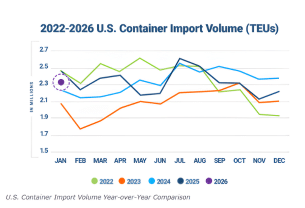

U.S. containerized import volumes reached 2,318,722 TEUs in January, showing a seasonal rebound from December’s slowdown and slightly exceeding the long-term average for the month.

An indicator that import activity is normalizing amid uncertain trade conditions.

The World Economic Forum highlights that global supply chains are facing increasing uncertainty due to geopolitical tensions, rising costs, and fragmented trade policies, making resilience more critical than ever.

We are committed to helping customers navigate these challenges with adaptive, data-driven solutions that maintain supply chain reliability and minimize disruption.

The European Commission and India strategic agenda through 2030 aims to strengthen trade, supply-chain integration, and regulatory cooperation, fostering a more resilient and diversified global economy.

This partnership signals enhanced opportunities for smoother cross-border shipping, improved market access, and more predictable trade flows between Europe and India.

Imperative Logistics has been named by Global Trade as one of the Top 50 3PLs for 2025 in the Border Breakers category, recognizing our expertise in navigating complex trade compliance and delivering multi-country freight solutions.

This honor highlights our dedication to providing reliable support that helps our customers adapt and stay resilient in a changing trade environment.

- International Emergency Economic Powers Act (IEEPA) Tariff Case: The U.S. Supreme Court is in winter recess and scheduled to reconvene on February 20. While not guaranteed, a potential opinion related to tariffs imposed under the International Emergency Economic Powers Act could be issued at that time.

- Historical Tariff Exposure: Importers should review historical tariff exposure, including Harmonized System (HS) codes, country of origin, and applicable tariff lines, to assess potential financial impact.

- Automated Commercial Environment (ACE) Automated Clearing House (ACH) Refund Information: Ensure Automated Commercial Environment (ACE) portal ACH refund information is current to avoid delays in any potential refund processing.

- Potential Tariff Actions: Importers should be prepared for possible implementation of 15% Section 122 tariffs or targeted Section 232 and 301 tariff actions.

- Official Guidance: Tariff measures are only effective once published in the Federal Register and formally communicated by U.S. Customs and Border Protection through Cargo Systems Messaging Service notices

- Tariff & Compliance Readiness: We support your tariff and compliance readiness efforts by reviewing available import data, discussing historical exposure considerations, and advising on documentation best practices.

- Customs & Refund Process Support: Our team assists with reviewing and updating customs portal access and Automated Clearing House (ACH) banking information to help prevent delays in tariff refunds or compliance-related issues.

- Scenario Planning & Risk Assessment: We help assess potential supply chain impacts under various tariff scenarios, including possible Section 122, Section 232, and Section 301 actions.

- Supply Chain Visibility & Routing Optimization: We work with you to identify alternative routing or consolidation strategies to maintain speed, security, and reliability amid evolving regulatory requirements.

- Regulatory Monitoring & Advisory Updates: We actively monitor trade policy developments and share timely insights as official rulings and U.S. Customs and Border Protection communications are released.

Have questions about how these tariff changes affect your shipments? Our team of experts is ready to provide guidance, please Contact Us anytime.